In recent years, sustainable investing has gained traction, but not all promises have been realized.

November 26, 2024

In recent years, sustainable investing has gained traction, but not all promises have been realized. The main challenge is implementing these strategies effectively, as sustainable universes often have sectoral, regional, and factor biases. Long/short investing offers a practical solution to neutralize these biases, capture climate-related investment opportunities and enhance sustainable investing's impact.

Effectively express views

Shorting is a powerful tool in investing, primarily because it allows for greater flexibility and precision in expressing investment views. In a long-only framework, the ability to underweight is limited by the benchmark weight. For instance, a 0.1% benchmark position can only be underweighted by 0.1%. However, in a long/short framework, investors can take significant short positions, and this minor benchmark position can be underweighted 1% or more. This enables investors to better express their convictions and improve risk management.

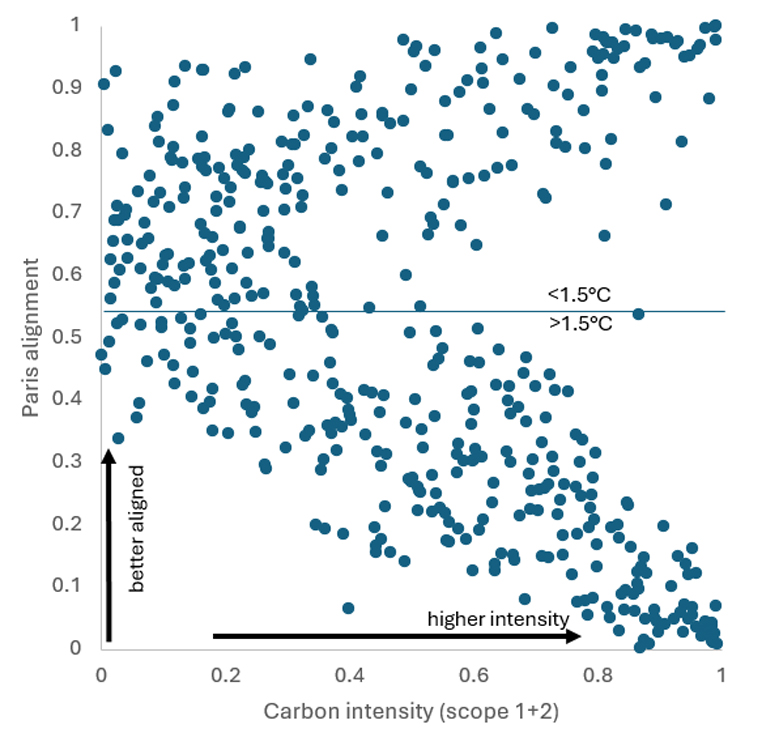

Figure 1. Paris alignment versus carbon intensity

Source: Trucost, own calculations. Data as of October 31, 2024

Consider for example an investor who cares about the carbon footprint of its portfolio. Figure 1 shows that low-carbon emitters tend to be more aligned with the Paris agreement. However, for high-carbon emitting companies it is very binary. They are either very unaligned, or very aligned. The latter provide the most attractive investment opportunities. Though, in a long-only setting, it is hard to invest in high-carbon, well-aligned companies and simultaneously keep the portfolio carbon risk low. Moving to a long/short world, it becomes easy to get exposure to attractive high-carbon companies that are on the right trajectory, while balancing the carbon footprint of the portfolio by shorting equally high non-transitioning companies. Such impactful longs would be a near impossibility for a long-only manager constrained by a carbon intensity that is lower than a broad equity benchmark.

Manage risk and biases

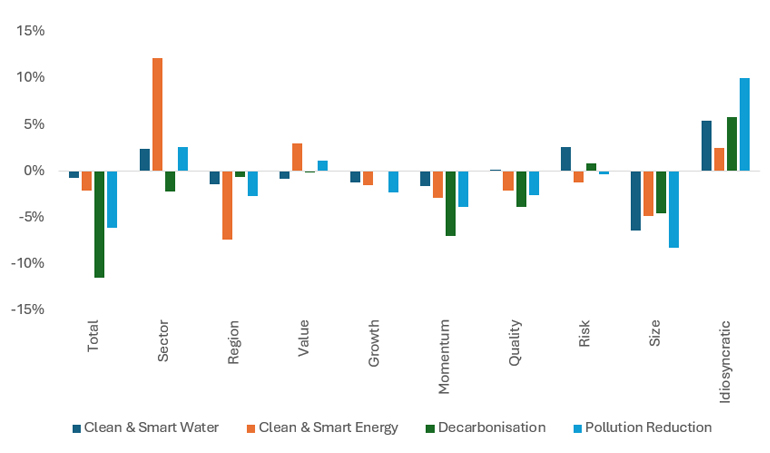

Sustainable investment universes, especially those focused on environmental impact, often have inherent biases. For instance, they over-represent certain sectors like Industrials and Materials and underrepresent other sectors such as Financials or Consumer Services. Similarly, regional biases can occur, with Europe dominating the landscape. Factor biases, such as growth over value, and a size bias towards mid-capitalization companies also emerge. All these biases combined distort relative portfolio performance compared to passive benchmark investing. Figure 2 shows the cumulative active performance contribution of four environmental themes1 compared to MSCI World. All four themes underperformed over the period from January 2015 to October 2024. We see that apart from some small positive low-risk contributions, all factor contributions are negative over the period. Particularly momentum, quality and size exposures detracted heavily in relative performance. Region and sector exposures varied wildly across the themes and over time.

The long-term attractiveness of the sustainable investing is shown in the positive idiosyncratic returns over the period. Long-short investing can mitigate unwanted sector, region, and factor exposures in the portfolio by hedging them with short positions. This approach creates a more balanced and diversified portfolio, maximizing exposure to the long-term investment thesis and potential positive idiosyncratic returns.

Figure 2. Performance attribution environmental themes (January 2015 – October 2024)

Source: Trucost, own calculations. Data as of October 31, 2024

Capture alpha opportunities

It’s important to recognize that long/short strategies are not just about reducing biases and managing risk—they also enable investors to harness additional alpha opportunities. By shorting, investors can better navigate the complexities of climate-related risks and opportunities. This can lead to superior risk-adjusted returns while advancing sustainable objectives. The prevailing narrative is that ESG or sustainability is not useful for alpha generation and is a tool of risk management. If this holds true, then having some exposure on the short side to high-risk companies, should pay off over time.

Additionally, the possibility of shorting broadens the investment universe and adds breadth to a manager’s skill. As illustrated in Figure 2, we believe that having a positive exposure to environmental themes is a long-term driver of performance. This happens through exposure to a mix of factors related to carbon risk, climate innovations, resource efficiency, sustainable revenues, lack of stranded assets, and transition sensitivity. Getting pure positive exposure to all of these in a concentrated long-only portfolio is prone to large volatility. A long/short approach allows to efficiently add these diversifying sources of alpha while managing risk.

Deliver impact

Furthermore, shorting aligns with the broader goals of sustainable investing by enabling investors to take active roles in promoting better corporate behavior. Companies often dread being shorted, as it signals investor dissatisfaction and can motivate them to address ESG shortcomings. Moreover, if investing in green companies lowers their cost of capital, then a long/short portfolio has a double benefit. By shorting, investors not only avoid investing in unsustainable companies but actively contribute to increasing their cost of capital, thus discouraging unsustainable behavior more effectively than merely avoiding them. By shorting companies that are significant carbon emitters or have poor ESG practices, investors can signal these firms to improve their practices, as a higher cost of capital can deter unsustainable projects. The arguments for long-only impact investing hold true and are even enhanced in a long/short framework.

Conclusion

In conclusion, long/short sustainable investing offers a robust framework for addressing the biases inherent in sustainable universes, enhancing impact, and capturing additional alpha opportunities. By leveraging short positions, investors can exert greater influence over corporate behavior, effectively manage risks, and contribute to a more sustainable future. As sustainable investing continues to evolve, long/short strategies will likely become an integral part of the ESG and impact investing landscape, providing investors with the tools needed to navigate the challenges of the climate transition.

1. Portfolios are constructed by screening MSCI World on revenues related to the four environmental themes.

Companies with positive exposure of >5% are kept and the weights are taken proportional to the revenue exposure. Rebalancing is done monthly.

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.