One week after the outcome of the US election, we assess the impact of this significant political change on financial markets with a focus on climate impact investments.

November 15, 2024

New political landscape in the U.S.: The Path Forward for Environmental Impact Investing

One week after the outcome of the US election, we assess the impact of this significant political change on financial markets with a focus on climate impact investments. With a Republican majority in the Congress, Donald Trump will have the political power to implement (or try to) most of the measures announced during his campaign.

The macro-economy

From a macro-economic point of view, there is a large consensus on the fact that Donald Trump’s plans are inflationary (immigration and trade barriers), positive for US domestic growth (lower taxes and deregulation), and fiscally expansionary. Historically, during such economic regimes (inflation + growth) interest rates rise. If they rise excessively, it could negatively impact both the economy and financial markets. Consequently, it remains currently challenging to ascertain the net positive benefits of this election. Much will depend on the future U.S. government deficit and how U.S. Treasury bond investors will respond.

Energy policy and renewables

Regarding the energy policy of Donald Trump, we can already make a few highly probable predictions:

- The U.S. will likely withdraw from the Paris agreement.

- Restrictions on fossil fuels drillings will be significantly eased.

- The Inflation Reduction Act will not be canceled, but part of the remaining budget may be withdrawn.

- Offshore wind farm projects could be banned or even dismantled.

- Investments in nuclear power are expected to increase, being the only environmental topic on which both Republicans and Democrats agree.

These prospects are no great news for the climate, biodiversity or the renewable sector. However, even slowed down, the global momentum behind the shift to cleaner energy is unlikely to reverse. Ultimately, the future of renewable energy will be driven by its economics: The price of renewables and the increase in global energy demand.

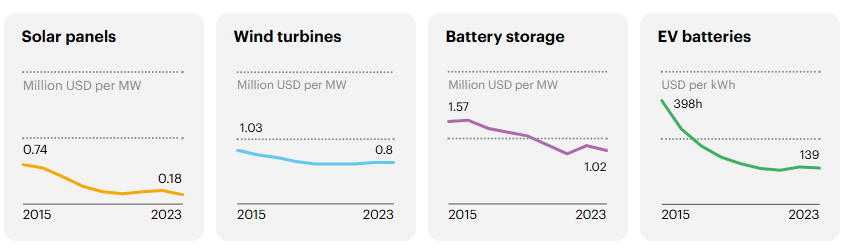

Figure 1: Prices of clean energy technologies

Source: IEA World Energy Outlook 2024

Recently, the demand for renewable energy is increasing at a higher pace than for coal and natural gas driven by price reductions of clean energy technologies, which have become highly competitive compared to fossil-based sources. We see no reason for this trend to halt.

Impact for other environmental impact activities

Other than funding cuts from the IRA, we do not foresee other direct consequences of the political changes on companies that are active in water, decarbonization, and pollution reduction themes. However, there may be additional indirect consequences if interest rates rise excessively, which is especially true for capital intensive activities such as water distribution (e.g. water utilities) and sustainable transportation (e.g. railroad transportation). Activities such as environmental services, and sustainable building materials are likely to remain largely unaffected.

Conclusion

If we assess market movements around the election outcome, recent political changes in the U.S. have not significantly impacted our portfolio investments. We have benefited from the outperformance in small- and mid-capitalization companies, as well as from cyclicals. We believe that in 2025, most of the focus will be on governments’ budget deficits. If these increase excessively, they could start impacting interest rates and drive the performance of most asset classes downwards. In this context, portfolio and impact theme diversification are the best risk mitigants to navigate this environment.

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.