This note explores the potential of impact investing in liquid equities to achieve both financial returns and significant social and environmental impacts.

December 6, 2024

This note explores the potential of impact investing in liquid equities to achieve both financial returns and significant social and environmental impacts. It first examines the distinctions between impact investing and ESG strategies, highlights the differences between impact-aligned and impact-generating approaches, and discusses its implementation in equity portfolios.

Impact investing versus ESG

ESG (integration or best-in-class) focuses on the way firms operate (the “How”) whilst impact investing consists in creating a portfolio of companies providing solutions (the “What”) to enhance specific social and environmental outcomes, guided by frameworks like the UN SDGs or EU taxonomy. The intentionality associated with impact investing leads to a focused investment universe with biases towards certain industries and smaller companies, resulting in a higher tracking error compared to ESG strategies.

Impact-aligned versus impact-generating

Busch et al. (2024)1 differentiate between impact-aligned and impact-generating strategies, both aiming to achieve impact but differing in measurement. Impact-aligned strategies assess impact at the company (investee) level (e.g. tons of CO2 emissions avoided from investing in a renewable energy producer), while impact-generating strategies measure contributions from both the company and investors (e.g. investment in firm X contributed to create 100 jobs). Listed asset strategies typically fall under the impact-aligned category, whereas private asset strategies are impact-generating. Indeed, private investors’ contributions are easier to assess because they generally have both higher control and higher additionality.

Financial returns

Impact-aligned strategies derive their long-term performance through:

- Cash-flow growth predicted for leaders in social and environmental solutions (e.g. solar energy).

- Lower cost of capital due to a lower exposure to future risks (e.g. transition risks) than companies that provide products that are harming the environment and/or the society.

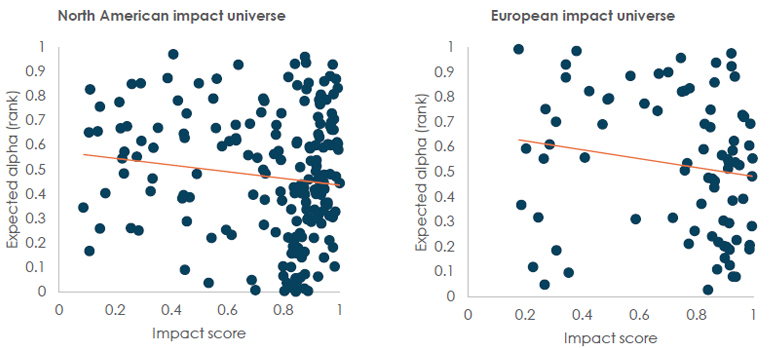

However, in the short run, discrepancies exist between impact (as represented by our impact score) and alpha as shown by the slight negative correlations in Exhibit 1.

Exhibit 1: Relationship between expected impact and expected alpha

Source: Asteria. Data as of September 30th 2024. The universes are made of companies whose products and services contribute to SDGs 6, 7, 9, 12, 13, and 15.

To generate financial return alongside impact, we focus on companies that are in the upper-right corner of Exhibit 1. It ensures that our capital is being used efficiently, supporting firms that are likely to succeed and drive meaningful environmental changes.

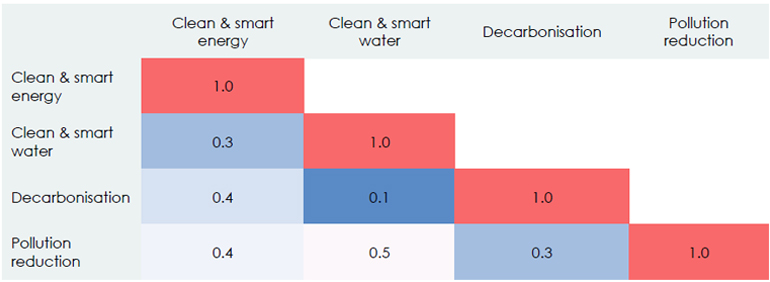

Finally, we mentioned above that impact investors face concentrated investment universe. It is therefore of paramount importance to construct impact equity portfolios that are as diversified as possible. There are two distinct ways to enhance the level of diversification. First, by mixing the impact objectives of the portfolio. Indeed, sector tilts and factor exposures (e.g. growth versus value) differ across impact themes, which results in low correlations of excess market returns across impact themes.

Exhibit 2: Historical correlations of excess market returns for environmental impact themes

Source: Asteria. Benchmark: MSCI ACWI. Impact theme portfolios are equally weighted. Calculation period: January 2012 to September 2024.

The second diversification source is the number of positions. Indeed, by relying on an extended number of positions (100 to 120), the long-run performance of the portfolio will tend to be more consistent through time and its risk will be lower. A systematic approach enhances the chances of success if one decides to follow this approach as it enables to efficiently cover higher investment universes.

Conclusions

Impact investing in liquid equities offers a powerful approach to aligning financial goals with social and environmental objectives. Although impact investing presents challenges, such as a concentrated investment universe and higher tracking errors, strategic diversification, robust portfolio construction, and careful selection of companies can mitigate these issues. Ultimately, impact investing not only contributes to a sustainable future but also positions investors to benefit from the growth of industries shaping that future.

1. www.eurosif.org/wp-content/uploads/2024/02/2024.02.15-Final-Report-Eurosif-Classification_2024.pdf

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.