The EU elections have brought back sovereign risk to the forefront in Europe. The announcement of snap elections in France couldn’t come at a more uncertain time when investors ponder the trajectory of inflation, the economy and of valuations. In this article, we skip the political debate and focus on sizing French risk across IG markets including green bond and the implications for investors.

June 30, 2024

The EU elections have brought back sovereign risk to the forefront in Europe. The announcement of snap elections in France couldn’t come at a more uncertain time when investors ponder the trajectory of inflation, the economy and of valuations. In this article, we skip the political debate and focus on sizing French risk across IG markets including green bond and the implications for investors.

Spending “beaucoup” of money

France was downgraded by one-notch by S&P from AA to AA- (stable outlook) in May on the back of expected rising debt levels over the coming years. The rating action follows that of Fitch in April 2023 which downgraded the country to AA-, while Moody’s rating sits higher at AA2, on stable outlook.

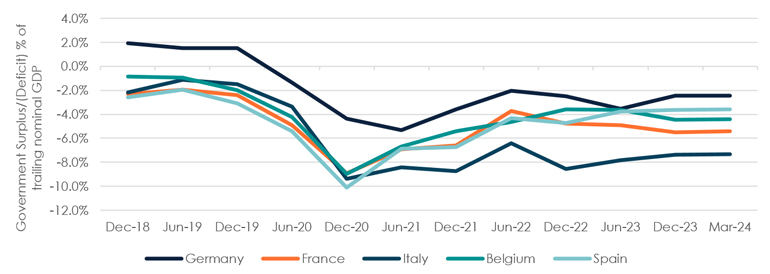

France remains the second largest economy in Europe with a nominal GDP of 2.8trillion Euros, the government’s deficit has increased to exceed 5%. This contrasts with its neighbours such as Belgium (AA3 rated) and Spain (A3 rated) which have improved or stabilised their deficit and have similar debt to GDP levels at around 105%.1

France’s spending has accelerated in the past years

Source: Asteria IM, Eurostat

French risk premium jumps

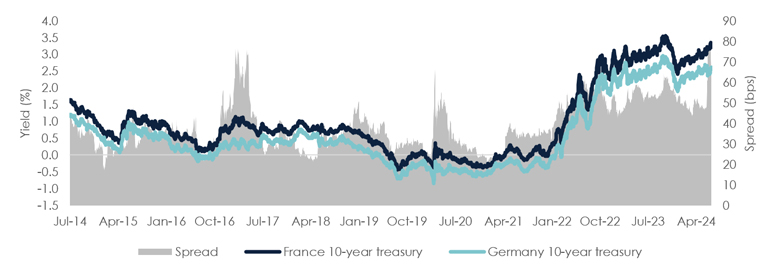

The combination of the credit rating downgrade and Macron’s announcement of snap elections resulted in a jump in French risk premium (credit spreads) to levels last seen in 2016, when Trump was elected, and France saw a heightened risk of right-wing populist surge.

French sovereign risk jumps to 2016 levels

Source: Asteria IM, Bloomberg.

France’s 10-year risk premium (yield differential versus Germany) jumped from 50 to 80bps or a 30bps increase, similarly to what happened in Q4 of 2016. At the time the debt to GDP ratio was 100% (or 10 points below the current level) and the government’s deficit was also lower in the 3.5-4% range, in contrast to the current 5%-5.5% range.

The fiscal situation and election uncertainty will continue to weigh on French sovereign risk. Investors can expect political forces to talk down volatility, but regardless investors need to price a challenging fiscal position.

Corporate spread contagion

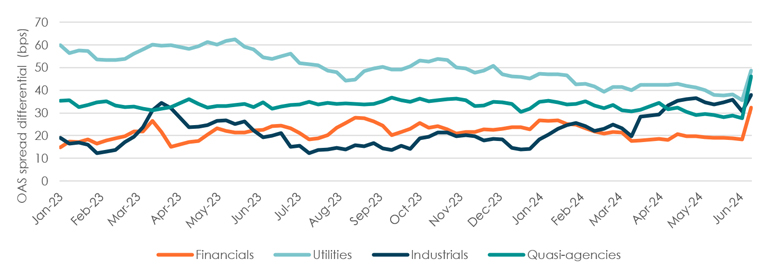

We build French risk portfolios by sector and compare the Option Adjusted Spread to equivalent sector portfolios to measure the French corporate risk premium.

French corporate spreads widen on the back of increased sovereign risk

Source: Asteria IM, ICE Index.

The recent volatility has pushed French corporate spreads wider by 14bps for financials, 13bps for utilities and 7bps industrials, with industrials and financials spreads above 2023 levels. Intuitively, quasi-government entities sold off the most by 18bps, as the issuers are closely related and influenced by government policies and funding.

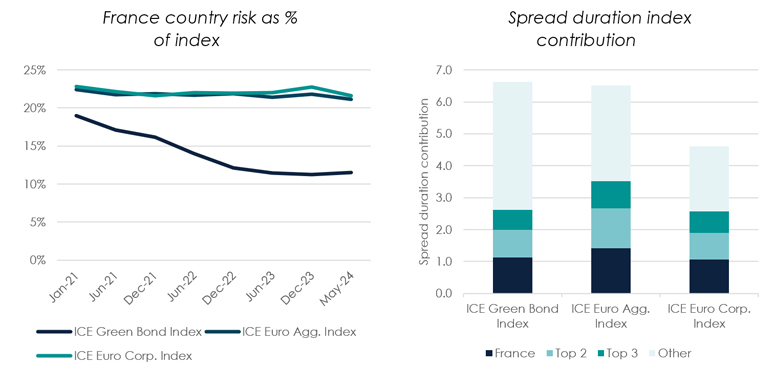

France risk exposure in fixed income markets

France remains among the top country exposures across markets accounting for 22% in the ICE Euro Aggregate Index and ICE Euro Corporate Index. In turn, it has declined from 20% to 10% in the ICE Green Bond Index as the green bond market growth broadened over the past years. Nevertheless, the largest source of credit risk sensitivity (spread duration) comes from French issuers across selected markets.

France country exposure is the largest source of risk across selected markets

Source: Asteria IM, ICE Index, as of May 2024.

French exposure has noticeably declined in the ICE Green Bond index as the tremendous growth over the past years brought greater diversification across countries, currencies and sectors. On the other hand, France remains the main driver of credit risk sensitivity accounting for 23% of the index spread duration for the Euro corporate index, 22% for the Euro aggregate index and 17% for the Green bond index.

Sector exposures

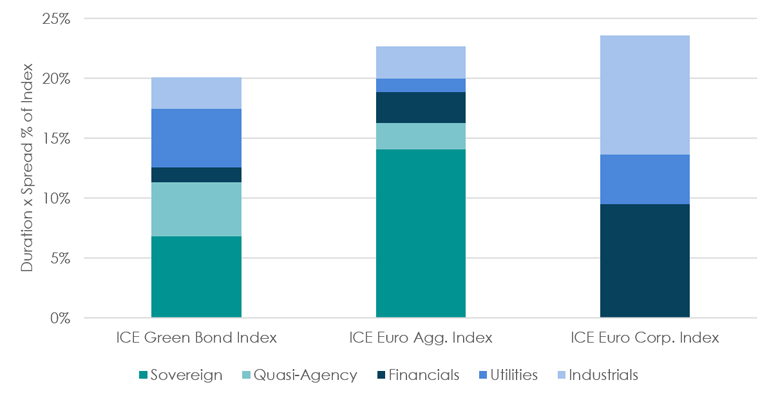

French-risk exposure is not the same across markets, this consideration will become more important once there is more visibility on the impact of policies on the French issuers and the economy. Duration times spread (DTS) is a useful risk-management measure that gives the absolute magnitude to credit risk. A sector approach can be a useful roadmap for investors to assess a top-down view on how policy risk can impact sectors and thus spreads.

French-risk sector based DTS risk differs widely across markets

The ICE Green Bond index has the lowest DTS exposure to French risk of 20%, followed by the 23% for the Euro Agg. index and 24% for the Euro Corporate index. Noticeably, the ICE Green Bond index has a lower DTS exposure to French sovereign and quasi-agencies compared to the Euro Aggregate index of 11% compared to 16%. Investors worried about further deterioration in France’s fiscal performance would be most affected via the Euro Aggregate index. In turn, corporate bond investors have most exposure through financials and industrials which account for close to 20% of the index DTS. Utilities are the outlier where the exposure is larger in the ICE Green Bond index, rather than in the Corporate bond index.

Implications for investors

French risk will continue to weigh on European markets. It is still early for investors to fully price the impact of the new national assembly's composition and policies on credit risk. Investors should be acutely aware of the differences across bond markets in terms of exposure to French risk and how these may impact returns over the coming quarters.

The green bond market is interestingly positioned to offer investors a lower exposure to French sovereign and agency risk compared to a traditional aggregate index, while offering more exposure across corporates. As a result, an active and opportunistic approach allows to navigate the continued political uncertainty.

1. Eurostat data, trailing four quarter nominal GDP, as of March-2024.

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.