The first six months of 2024 closed with mixed set of results across fixed income markets.

August 7, 2024

Green Bonds H1’24: Focus on performance

The first six months of 2024 closed with mixed set of results across fixed income markets. The risk-on environment continued throughout the period; favoring markets with low exposure to interest rates and high credit spreads. High yield bonds outperformed, followed by flat IG corporate returns and treasuries closing in the red. Green bonds performed in-line with their conventional benchmarks, but is this down to luck or can we expect this trend to persist going forward?

The article seeks to tackle the thorny issue of sustainable investment underperformance which is often blanketed across all asset classes. Fortunately, this has not been the case for green bond markets which performed in-line with their conventional benchmarks in H1 2024. This has important implications for investors where green bonds deliver market returns with the added benefit of financing the climate transition and decarbonizing portfolios.

H1’24 same mantra: long spreads, short duration

Performance for the first half has been driven by the same mantra of buying high credit spreads and avoiding high duration bonds. Interest rates in Europe sold off by more than 40bps; driven by a repricing of expectations for interest rate cuts. In turn, the positive risk-on environment supported the credit spread rally, especially in Europe where HY spreads tightened by more than 40bps and IG spreads by 20bps.

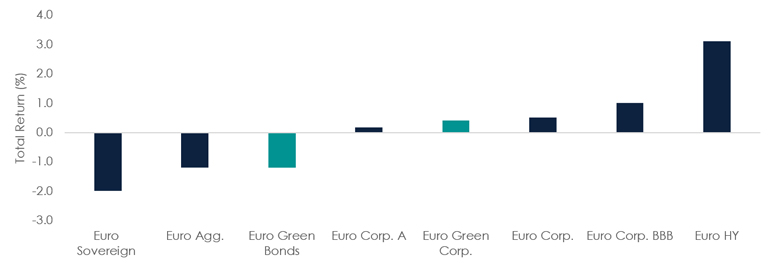

H1’2024 total returns across Euro fixed income markets

Source: Asteria IM, ICE Index

The Euro High Yield index delivered a solid 3.1%, followed by BBB corporate bonds and a mere 0.5% for the corporate index. In turn, Euro Aggregate index returned -1.2%, while treasuries underperformed on the back of rising interest rates and the sell-off in French treasuries.

Most importantly, the Euro Green Bonds (aggregate index) and the Euro Green Corporate indices delivered an in-line performance with respect to their conventional benchmarks.

Green Fixed Income Performance

The debate about the performance of sustainable investment solutions continues, especially for sustainable equity funds which have broadly underperformed conventional indices.

Jess Henry, Responsible Investment Specialist at Man Group, commented that this is primarily driven by specific construction biases such as being overweight rate-sensitive small caps, high duration cash flows, and being underweight industries which have outperformed, such as Tech and Communication Services. As a result, Article 8 and Article 9 equity funds posted negative average relative returns vs benchmarks in H1 2024; -0.89% and -5.22% respectively. In contrast, Article 8 and Article 9 fixed income funds fared better, with Article 8 funds outperforming benchmarks by 0.32% and Article 9 underperforming but by only -0.36% (vs -5.22% for Article 9 equity)1. This is largely due to the fact sustainable fixed income solutions do not suffer to the same extent to these biases given the greater diversification, lower concentration of returns and similar characteristics in terms of spreads and duration.

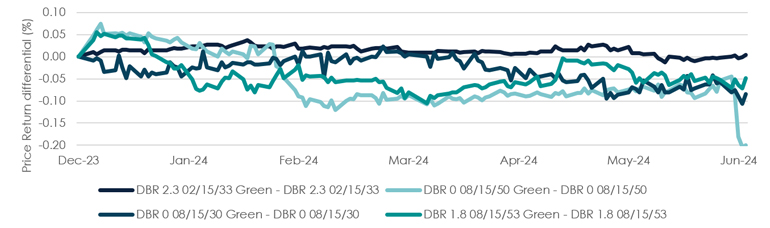

Furthermore, sustainable fixed income instruments such as green bonds do not have contractual differences from “vanilla” instruments. The twin-bond concept of the German Federal Government is a great example where a green bond is issued with the same maturity date and coupon (albeit different size) than its conventional counterpart.

Back to basics: bonds with similar characteristics deliver similar returns

Source: Asteria IM, Bloomberg

The chart above shows the price difference between each twin-green bond pair of the German Federal Government, note that each bond has a different face value amount, typically non-green bonds will be much larger. The price return difference remains particularly narrow at a few basis points. For the twin-pair maturing in 2033, the non-green bond returned -3.649% while the green bond returned -3.648%, or close to 1bps difference. Similarly, for the twin-pair maturing in 2053 the non-green bond returned -8.66% compared to -8.70%, or 4bps difference. The outlier is the twin-pair bond with maturity in 2050 which saw a steep drop in performance following the results of the EU elections possibly driven by specific investor demand, liquidity needs and size.

Green performance: converging towards the “market”

Relative performance of green bonds compared to conventional benchmarks should start to become more similar; as green bonds grow, their characteristics converge towards those of the “market” i.e. conventional benchmarks.

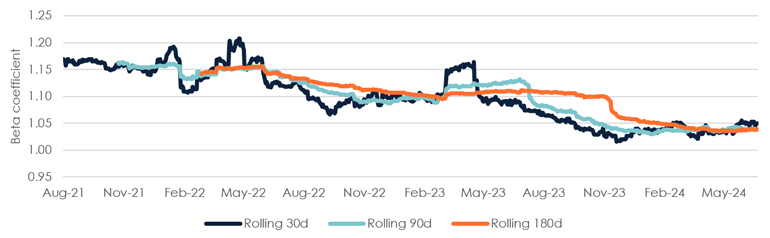

To test the hypothesis that green bond index performance is converging to its conventional benchmarks, we run multiple rolling regressions on two sets of indices: the ICE Euro Green Bond and Euro Green Corporate index against the Euro Aggregate and Euro Corporate index. We would expect alpha (i.e. the relative performance) to not be meaningful and the beta coefficient to converge towards 1.0 i.e. the market.

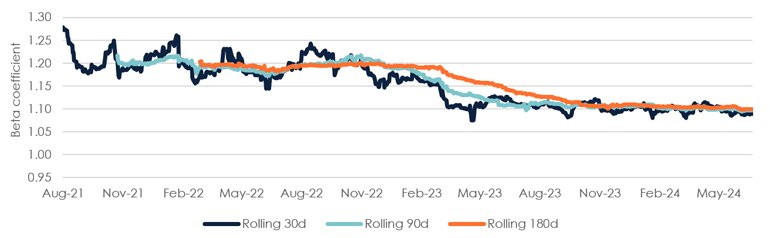

Case Study: Euro Green Bond

Alpha: flatlining towards zero

Beta coefficient: converging towards the market

Daily rolling linear regression between the total return of the ICE Euro Green Bond Index against the total return of the Euro Aggregate Index. Source: Asteria IM, ICE Index

The regression results support the hypothesis that “green” over/underperformance (alpha) has been flatlining over time towards 0, with an average of close to 0 and not statistically significant. In addition, the beta coefficient (sensitivity to benchmark total returns) has also been trending lower over time, albeit it has plateaued since the October 2023 at 1.10. This means that the Euro Green Bond index can be viewed as a beta-play with respect to the Euro Aggregate index, with the benefit of gaining green fixed income exposure.

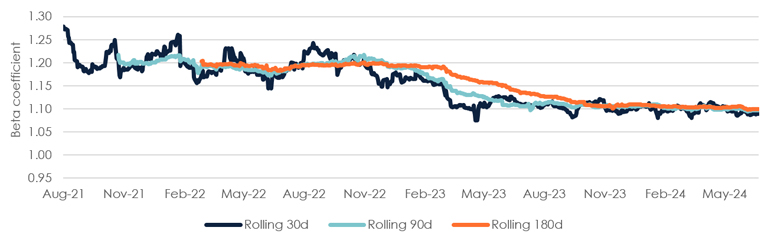

Case Study: Euro Green Corporate Bond

We find that the hypothesis holds also for the Euro Green Corporate index with similar results and trends as the previous example.

Alpha: flatlining towards zero

Beta coefficient: converging towards the market

Daily rolling linear regression between the total return of the ICE Euro Green Corporate Bond Index against the total return of the Euro Corporate Index. Source: Asteria IM, ICE Index

The ICE Euro Green Corporate index alpha has been flatlining and on average is not statistically significant and the beta coefficient has been trending lower towards 1.0.

Implication for investors

These results contrast with the perception that sustainable investments across asset classes have persistently underperformed; although this has been the case for many equity funds, fixed income investors have reason to believe otherwise. This has paramount implications for investors; green bonds can increasingly be seen as interchangeable with vanilla bonds in terms of performance, albeit with a higher beta, with the added benefit of contributing to financing the vital climate transition and decarbonizing their fixed income allocations, without suffering from performance differences.

With contributions from Jessica Henry, Responsible Investment Specialist, Man Group

1. SFDR funds weighted average relative returns June YTD (USD). Morningstar data and Man Group analysis

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.