The automotive industry is at the heart of the global climate transition, technologies and geopolitics.

September 30, 2024

Slamming on the brakes: Automotive’s challenges with EVs

The automotive industry is at the heart of the global climate transition, technologies and geopolitics. These factors should be tailwinds for the industry, yet car manufactures have slammed on the brakes on their EV ambitions.

The turbulence has started to impact credit spreads with European autos underperforming on a YTD basis. The outlook remains challenging but brings opportunities for active bond pickers, while navigating one of the main engines of the energy transition.

EU imposes tariffs on Chinese EVs

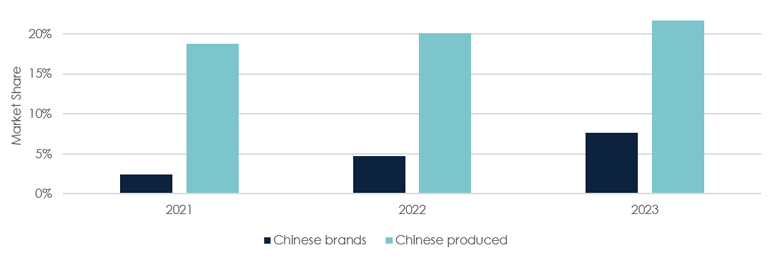

The European Commission will impose tariffs on imported electric cars manufactured in China. Chinese produced EV registrations in the EU jumped by 1,830% since 2021, while prices fell by 10%1.

Chinese-brand EVs gain significant market share in Europe

Source: Asteria IM, ACEA “EU-China Vehicle Trade”

The unfair gain from Chinese competition has aggravated the challenges of low productivity and high costs of European operations; jeopardizing further investments in EVs.

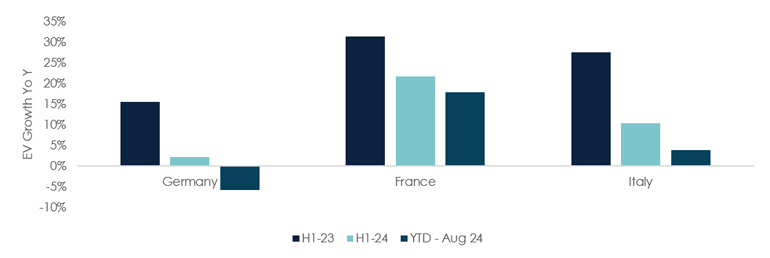

Fiscal budgets and incentives

EU governments have cut on incentives which are vital given the high price tag for EVs. Germany’s incentive program ended in December 2023 (a year early) to cut its budget. In February, the French government cut incentives for high-income earners and the new cabinet may cut them again to shore its finances.

EV sales stumble on the back of weaker incentives

Source: Asteria IM, ACEA August-2024

The latest figures highlight the significant slow-down in EV sales; especially in Germany with sales down 5% on a YTD basis2. In turn, Italy approved an incentive package in the summer which should help sales recover.

Slamming on the brakes: not only an EU story

European and US manufacturers are struggling to implement their EV strategies leading to delays of product launches, downsizing and even plant closures.

Volkswagen announced a potential closure of an Audi EV factory in Belgium to save costs3. In the US, Ford has announced it would re-calibrate its EV strategy including a reduction in capital expenditures from 40% to 30% for EVs4. General Motors announced that it would delay the opening for its electric pick-up plant5.

Battery technology: key to success

The success in scaling profitable EV platforms depends on the battery ecosystem. Song Jie, Senior Responsible Investment Researcher at Man Group, points to internal research highlighting themes across the battery industry such as the need to vertically integrate.

BYD, one of the global Chinese leaders in EVs, is vertically integrated with operations spanning across sourcing of minerals, battery production and EV manufacturing6.

EU and US firms have lagged in investing in the battery ecosystem with a high dependence on the Chinese market and Asian technology leaders such as CATL, Samsung and LG Chem.

Valuations and Outlook

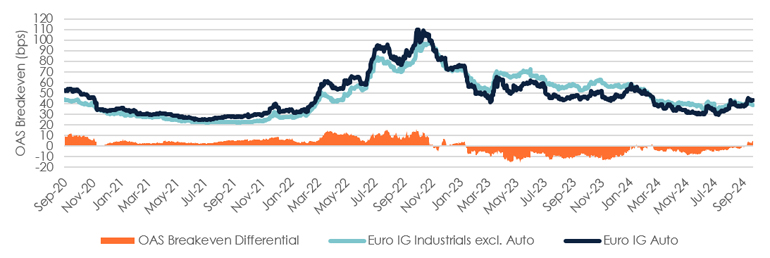

Euro automotive spreads have tightened this year which leaves limited room for upside, given the sector challenges and macro weakness.

Automotive spreads have started to underperform the broader market

The series excludes the top and bottom 10th percentile of OAS Breakeven: spread per unit of risk

Source: Asteria IM, ICE Euro Industrials Index (EJ00 Index)

Auto sector spreads have now widened above Euro industrials spreads, albeit remain below year-to-date levels.

Conclusion

The auto sector is facing multiple challenges at the issuer, sector and global level as the EV growth engine slows down. While the outlook is dire, this is not a U-turn on EV ambitions rather more of a bump on the road. An active bond approach is well-suited to take advantage of credit widening opportunities, while allocating capital to the climate transition.

With contributions from Song Jie, Senior Responsible Investment Researcher, Man Group

1. European Commission L_202401866EN.000101.fmx.xml (europa.eu)

4. Ford Motor Company Ford-Broadens-Electrification-Strategy-news-release.pdf (q4cdn.com)

5. BloombergNEF GM CEO Barra Backs Away From One Million EV Production Goal (1) | BloombergNEF (bnef.com)

6. Financial Times Chinese carmaker BYD held talks with lithium producer in Brazil (ft.com)

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.