In 2023, the planet has endured the hottest summer ever recorded, coupled with a surge in extreme weather events.

Interest rates, inflation, and the environmental transition

In 2023, the planet has endured the hottest summer ever recorded, coupled with a surge in extreme weather events. The consensus is unequivocal: achieving net zero is imperative, not a luxury. Every investor is affected by this reality, which creates risks for their portfolio but can present attractive long-term investment opportunities.

Indeed, companies whose products and services contribute to achieving the environmental transition (green companies) will derive benefits from it. As opposed to brown companies, whose valuations shall deteriorate as investors start to discount the impact of the environmental transition on their profits.

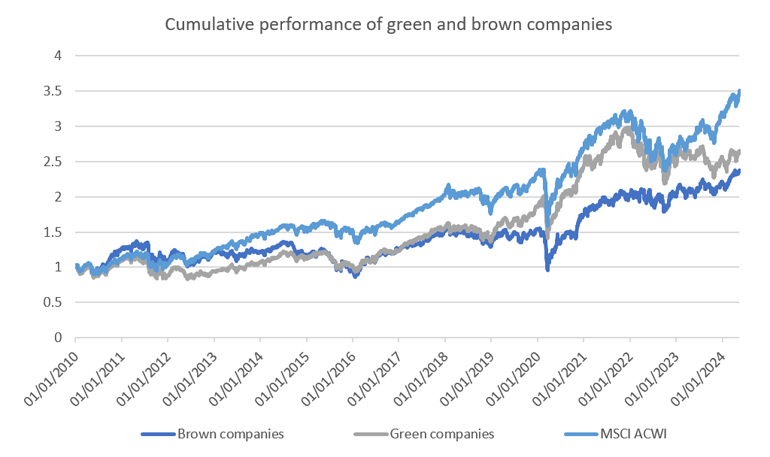

Figure 01: Cumulative performance of green and brown companies

Source: Asteria IM, Bloomberg, and TruCost. Data as of April 29th 2024. Benchmark: MSCI ACWI net total return in USD. Note: Green companies are companies that derive more than 50% of their revenues from activities that contribute to accelerate the environmental transition. Brown companies are companies that derive more than 50% of their revenues from activities that are detrimental to the environmental transition. The portfolio with the activities are equally-weighted with a quarterly rebalancing. All performance numbers are gross of transaction fees.

Figure 1 shows that until 2022, green companies outperformed brown ones and delivered a performance that was in line with the market. Starting in 2022, we see that the spread between green and brown companies started to narrow. As did the spread between green companies and the market.

What happened?

The transition to a greener economy creates both opportunities and challenges for participants across capital markets. A robust investment process will help capture the benefit of capital flows into the transition.

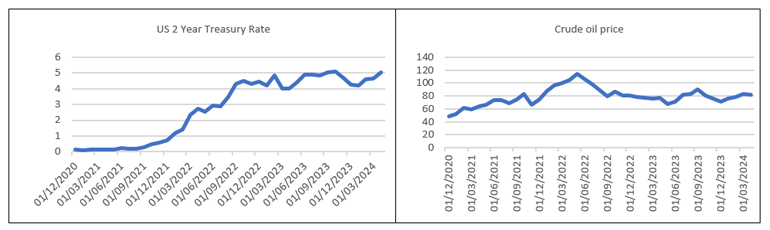

- Interest rates: central Banks had to increase the level of interest rates to curb inflation. Protecting our planet requires unprecedented large-scale investments in technological innovations and renewable energy projects. Consequently, these projects requiring high upfront capital investment have been heavily penalized as interest rates rose.

- Energy security: the energy crisis that followed the invasion of Ukraine by Russia drove fossil energy prices upwards. Oil prices rose by 136% between December 2020 and May 2022. This generated billions of profits for brown companies, leading their share price to rise significantly.

- Digital rally: finally, in 2023, most of the world equity market performance was generated by seven companies that are not green nor brown. Indeed, Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA and Tesla outperformed by a large margin. Without these companies, the world equity market indices would have finished the year almost flat.

Figure 02: US 2 Year Treasury Rate and Crude oil price

Source: Source: Bloomberg, Asteria. Data as of April 30th 2024.

There are several reasons for which we can be optimistic about the future performance of green companies for the forthcoming years:

- Interest rates have peaked: As inflation becomes under control, interest rates should stop rising, consequently, the cost of the investments will stabilize.

- Interesting valuation level: Green companies have generally become cheaper than the market, have higher long-term profit growth prospects, and are more profitable. This can be seen from Figure 2, which depicts the expected long-term profit growth outlook of the companies versus their current valuation level. The bubble size depicts their return on equity. This is particularly true for renewable energy, power storage, and renewable energy companies.

- Despite the electoral supercycleand potential leadership, which could imply slowing and volatility about countries’ climate ambitions there is a growing consensus on

- The contribution of greening the economy to price and financial stability

- The costs implied from delaying the transition.

The transition to a greener economy creates both opportunities and challenges for participants across capital markets. A robust investment process will help capture the benefit of capital flows into the transition.

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.