Impact investing is a long-term investment strategy, which considers that companies that are providing products and services that can accelerate both the environmental and social transition will experience higher capital gains than their peers.

February 21, 2024

Impact investing is a long-term investment strategy, which considers that companies that are providing products and services that can accelerate both the environmental and social transition will experience higher capital gains than their peers. The consequences to get exposure to these companies are 1) accepting large sector deviations from the index, 2) having an allocation that is tilted toward mid-capitalization companies, and 3) being invested in companies that tend to be more capital-intensive than the rest of the market. Given these structural biases, we believe that both a disciplined systematic stock selection and a robust portfolio construction approach are the best way to deliver a long-term attractive risk-adjusted return together with impact.

In this note, we first provide an overview of our investment opportunity set, we then briefly come back on the performance of environmental impact investments in 2023 and conclude with our views for 2024.

The investment universe

The investment universe is tilted towards utility companies, industrials, information technology (semis), and materials. For a typical impact equity fund, sector deviations contribute to at least 25% of the portfolio’s tracking-error with respect to the MSCI ACWI. Except for a significant mid-capitalization bias, there is no structural investment style bias attached to environmental impact strategies.

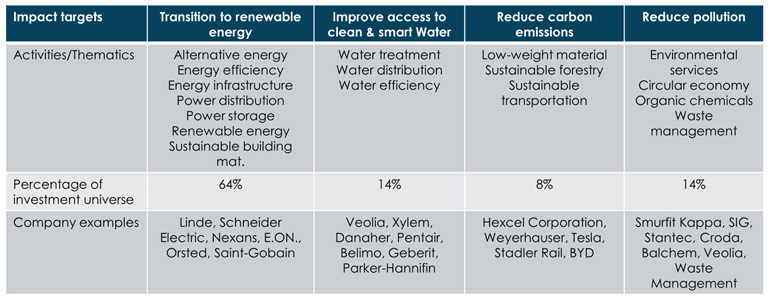

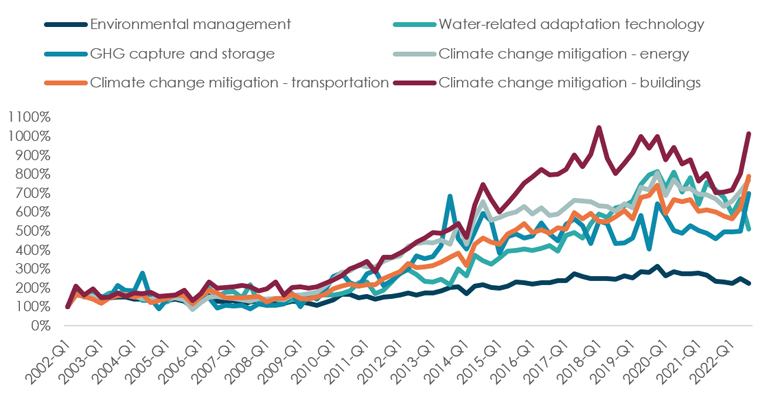

Figure 1. Environmental impact activities

What happened in 2023?

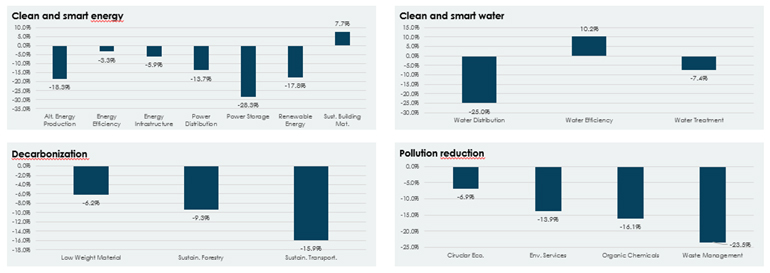

Last year proved to be very challenging for environmental impact activities. As can be seen from Figure 2, only companies active in the sustainable building material and water efficiency fields outperformed the market. All other activities underperformed.

Figure 2. 2023 Relative performance to MSCI ACWI

Note: Performance relative to the MSCI ACWI is equally weighted and gross of fees. Source: Asteria Investment Managers.

The main explanation for this underperformance is not related to the heightened political debate about the climate transition but simply to the increase in interest rates that started in 2022. Indeed, the mean-reversion in worldwide interest rates has put an end on the capex deflation area. It increased the costs of financing for companies that are active in the environmental transition, which tend to be capital-intensive.

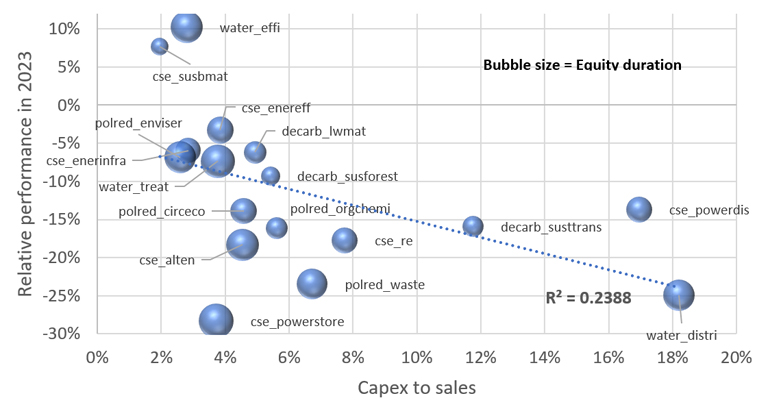

Figure 3 reports the link between capex to sales and the relative performance of the environmental activities. Capital-intensive activities (water distribution, power distribution, sustainable transportation) underperformed significantly in 2023. Even if it is less capital-intensive, power storage underperformed partly because of its high sensitivity to interest rates as most cashflows are occurring far in the future. Sustainable building materials is a low capital intensity activity with very low cashflow duration. This explains its outperformance in 2023.

Figure 3. The impact of capital expenditures on 2023 relative performance

Source: Asteria Investment Managers, S&P Capital IQ, MSCI, and Bloomberg. Benchmark: MSCI ACWI net total return. Performance relative to MSCI ACWI is equally weighted, gross of fees. Median values are used to measure capital expenditures to sales and equity duration for each group of companies1. Equity duration measures the sensitivity of the equity price to changes in interest rates2.

The bright spots for 2024

Rates high for longer but not much higher

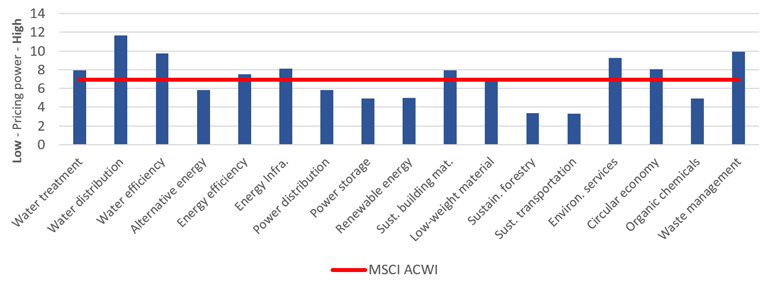

Around 80% of global installed wind and solar capacity has been put online and financed in a low-rate environment. Investors’ perception is that the roll-out of the low-carbon transition has been made possible by a low-rate environment. It is true that higher rates will continue to put pressure on the financing costs, however, as shown in Figure 4, most activities that are required to achieve the transition have the capacity to absorb these costs because they have the pricing power to do so. Sustainable transportation (railroad, EV, etc.) is more under pressure given the high level of capex of the activity. In the renewable energy space, power storage companies (e.g. battery producers) have a low pricing power but contained capex needs as well. Nevertheless, these latter two activities are expected to benefit from strong government support both in Europe (European Green Deal) and in the U.S. (Inflation Reduction Act).

Figure 4. Pricing power

Note: Pricing power computed as the median EBITDA margin to median of the 5Y volatility of the EBITDA margin for each activity. Source: Asteria Investment Managers, S&P Capital IQ, and MSCI.

The long-term tailwinds

There is now a very high probability that we will not be able to achieve the objectives of the Paris agreement. However, the outcome of the COP 28 and data show that the long-term tailwinds to solve the most acute environmental challenges that we face are still intact:

- COP 28 gave a confirmation that governments worldwide will continue to implement regulations to limit carbon emissions and invest to build the infrastructure needed to generate renewable energy

- Continuous innovation in green tech leads to higher efficiency and lower costs (see Figure 5).

- Consumer preferences will continue to shift towards sustainable products and services as their pricing becomes more competitive.

Figure 5. Growth rate of green patents across environmental activities

Source: Asteria Investment Managers, USTPO.

The concerns for 2024

In 2024, more than 50% of the world population will have to vote. As we know, one of the main debates surrounding these elections is the tradeoff between climate action and voters’ wallets. In the event of a Republican presidential victory in the U.S., we can expect a partial IRA repeal. The extent of this repeal will depend on the composition of the Congress. A governmental change will also impact the trade policy of the U.S. with China. This could impact some industries along the value chain that are crucial to achieve the transition such as batteries and semiconductors. We believe that the probability of a presidential change in the U.S. is already partially (but not fully) priced in the valuation of some activities such as solar, wind, batteries, and EV.

Our views for the activities

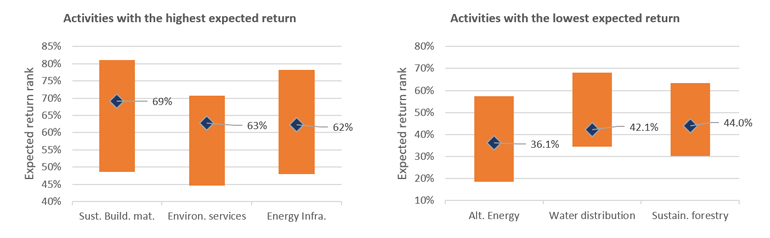

Our views are based on the expected alpha of our systematic stock selection model. We use a machine-learning decision-tree based model which combines more than 100 price-based and fundamental variables. Figure 6 reports the (ranked) alpha interquartile range and median (blue diamond) for the three most and least attractive activities. Sustainable building materials continue to be very appealing in our opinion. It is very attractively valued with a very high profitability. On the other hand, alternative energy is expected to under-perform as the companies are expensive, very volatile with quality credentials that do not exceed their peers. Nevertheless, for each activity, the range for the expected performance (heights of the orange bars) is large enough to find attractive candidates in each of it. In this task, our systematic stock selection process gives us an edge compared to our competitors as we can cover a larger number of companies in each activity, enabling sufficient diversification.

Figure 6. Expected return rank for environmental activities

Note: Blue diamonds are the median expected return rank for the activities. The orange bars depict the interquartile (Q75 to Q25) range of the expected return rank.

Source: Asteria Investment Managers.

Conclusion

We believe that selectivity in an impact investing universe will become more important than ever. The rising tide that lifted (and then lowered) companies in the most obviously exposed industries in recent years is over. Considering the rising financing costs, identifying the businesses able to benefit from the structural long-term growth that the market offers whilst managing short-term fluctuations will be increasingly critical.

1. cse_alten: alternative energy, cse_enerff: energy efficiency, cse_enerinfra: energy infrastructure, cse_powerdis: power distribution, cse_powerstore: power storage, cse_re: renewable energy, cse_susbma: sustainable building materia, water_treatement: water treatment, water_distri: water distribution, water_effi: water efficiency, decarb_lwmat: low-weight material, decarb_susforest: sustainable forestry, decarb_sustrans: sustainable transportation, polred_enviser: environmental services, polred_waste: waste management, polred_orgchemi: organic chemicals

2. See https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2680538

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.