Thematic investing has become a prominent strategy focusing on long-term secular trends such as environmental challengesi , technological innovations, regulatory changes, and socio-economic shifts.

May 23, 2025

Thematic investing has become a prominent strategy focusing on long-term secular trends such as environmental challengesi , technological innovations, regulatory changes, and socio-economic shifts. The goal is to achieve above-market returns by investing in companies positioned to benefit from these enduring trends. Typically, investors access these themes through thematic Exchange Traded Funds (ETFs) or Actively Managed Certificates (AMCs).

Being early matters for thematic investors

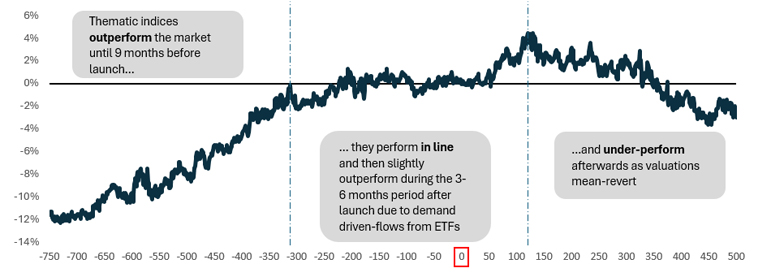

Academic researchii indicates that specialized ETFs often launch in response to short-lived investor enthusiasm, leading to initial overvaluation. This is depicted in Figure 1, which illustrates the median performance of MSCI thematic indices relative to the MSCI ACWI IMI over a five-year period surrounding their launch date. The median thematic index outperforms the market until about 9 months before it goes live and starts to underperform 6 months after launch. This underscores the importance of early trend identification and distinguishing between lasting trends and fleeting fads.

Figure 1: Median relative performance of MSCI thematic indices with respect to MSCI ACWI IMI

Source: MSCI, Bloomberg, Asteria IM. The study includes all MSCI thematic indices on the MSCI ACWI IMI universe launched in the period October 31, 2018 to April 30, 2025. We exclude multi-thematic indices from the study if the single themes are available as individual index. The event study comprises 45 thematic indices. All series are net total return in USD.

Using LLMs to identify emerging and fading themes

Conventionally, trend identification has been a manual process. However human analysts have limited bandwidth to continuously monitor and analyze the information required to identify a vast number of emerging trends. Furthermore, behavioral biases can affect their objectivity in getting rid of fading trends or accepting new trends.

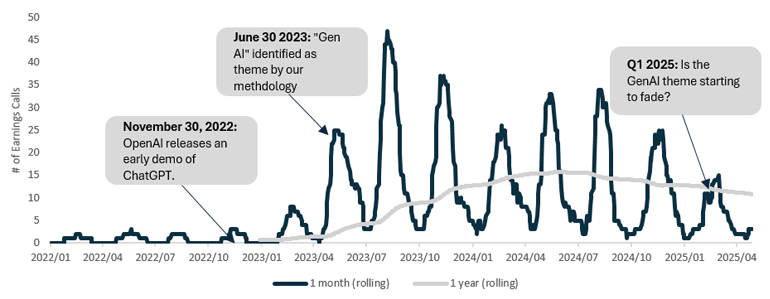

Natural Language Processing (NLP) can significantly enhance the identification of relevant and fading themes through topic detection in sources like earnings calls and corporate filings. By extracting business activity data from global earnings transcripts (~3000 companies) and employing a clustering approach that groups semantically related terms, we gain real-time insights into industry or global trends that may pose opportunities or challenges to top managers. Quarterly updates allow for a dynamic analysis of these topics, helping pinpoint growing and fading trends. Figure 2 illustrates our theme detection methodology for generative AI.

Figure 2: Number of earnings calls where Generative AI is identified as a key topic

Source: Asteria IM, Factset. Data as of April 30th 2025.

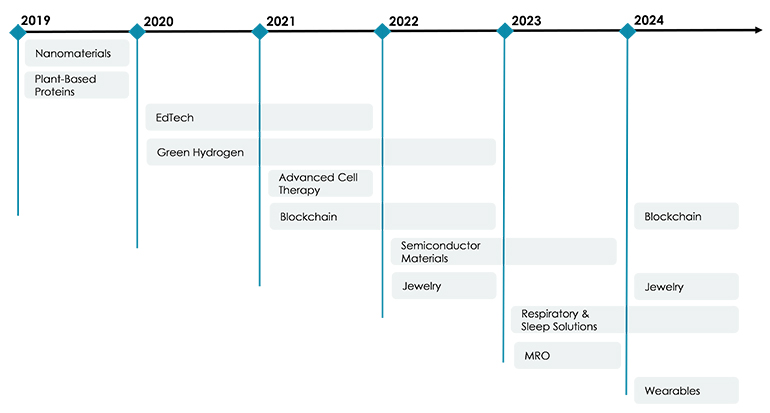

As shown in Figure 2, Generative AI remains an enduring theme. However, not all themes maintain their relevance; some are short-lived or fluctuate in significance. Figure 3 provides a historical, albeit non-exhaustive, overview of identified themes, such as EdTech and Advanced Cell Therapy, which surged in popularity during the COVID-19 crisis due to anticipated growth but subsequently underperformed as public and media attention shifted away from pandemic-related innovations.

Figure 3: Examples of (re-)emerging investment themes discovered through earnings transcripts

Source: Asteria IM.

Conclusion

Leveraging Natural Language Processing for thematic investing not only streamlines the identification of emerging and declining trends but also provides a more objective basis for investment decisions, free from human biases. Our approach demonstrates the ability to dynamically track and assess the viability of investment themes, offering a robust tool for investors aiming to capitalize on long-term, sustainable trends and avoid the pitfalls of staying invested in transient market fads.

iGuerdat, Natacha. Climate Megatrend 2025. Available at: https://www.asteria-im.com/climate-megatrend-2025.

iiBen-David, Itzhak Franzoni, Francesco A. and Kim, Byungwook and Moussawi, Rabih. Competition for Attention in the ETF Space. The Review of Financial Studies, Volume 36, Issue 3, March 2023, Pages 987–1042.

You are now leaving Man Group’s website

You are leaving Asteria Investment Managers’s website and entering a third-party website that is not controlled, maintained, or monitored by Asteria Investment Managers. Asteria Investment Managers is not responsible for the content or availability of the third-party website. By leaving Asteria Investment Managers’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.